The Principality of Monaco: a little-known attractive tax framework for the deployment of an international business activity

Monaco’s attractive tax system is commonly known for the total absence of income tax and wealth tax applicable to individuals residing in Monaco (other than French nationals), as well as the full exemption of gift and inheritance tax between spouses and in direct lines, giving rise to wealth planning opportunities for high-net-worth individuals.

Yet, the Principality of Monaco is also a destination of choice for the deployment of an international business activity by multinationals or foreign entrepreneurs.

Indeed, the Principality is an international onshore economic and financial centre that benefits from a central location within Europe, offering considerable operating advantages for the deployment of an international business activity on a day-to-day basis.

In addition to its ‘qualitative’ benefits, among which its sophisticated eco-system and rather low operating costs compared to London or other European economic hubs, the Principality provides for a stable and favourable business tax framework where corporate income tax applies only to certain business activities meeting a territorial criterion, including a five year progressive corporate income tax exemption for qualifying new businesses.

This article provides a high level overview of the main advantages offered by Monaco’s business tax framework.

A dynamic economic hub that meets international requirements for tax transparency and exchange of information

Although the Principality is neither a member state of the European Union nor the OECD, it offers the advantages of an independent state, while complying with the current international tax environment where transparency and exchange of information have become key.

Indeed, Monaco is a fully whitelisted jurisdiction for tax purposes per the Council of the European Union held on the 5 December 2017 where the Principality was withdrawn from any grey lists of non-cooperative states for tax purposes. The Convention on Mutual Administrative Assistance in Tax Matters developed by the Council of Europe and the OECD is fully applicable in Monaco and 35 tax information exchange agreements are currently into force.

Furthermore, the Principality is a participating country to the inclusive ‘BEPS’ framework (‘base erosion and profit shifting’) developed by the OECD, thereby committing to comply its tax legislation with OECD anti-abuse recommendations.

As a result of the above, Monaco generally does not fall under domestic tax anti-abuse mechanisms (CFC’s provisions, high taxation of transactions with blacklisted jurisdictions, etc) refraining multinationals and entrepreneurs from establishing a business in a tainted jurisdiction.

A stable and attractive business tax framework

Monaco does not provide for any direct tax on business profits other than corporate income tax (‘Impôt sur les bénéfices’) (‘CIT’) for certain business activities.

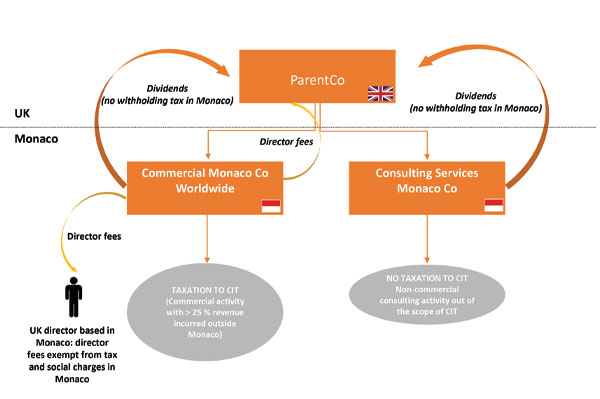

The scope of Monaco CIT is limited to commercial or industrial business activities which derive more than 25% of revenue outside of Monaco. Conversely, non-commercial business activity, such as strategic, intellectual or R&D consulting activities, are fully exempt from Monaco CIT.

In other words, CIT only applies when the two following cumulative criteria are met:

- A qualitative criteria, pertaining to the nature of the business activity: CIT applies only to profits derived from business activities of a commercial (eg sale of goods) or industrial (eg production of raw materials) nature; and

- A territorial criteria: CIT applies only if more than 25% of the revenue incurred upon the commercial or industrial activity is generated outside of Monaco. Conversely, if 75% of the revenue is generated in Monaco, no CIT applies (eg retail store activity).

By exception to the above criteria, CIT applies to companies whose business activity consists of earning revenue from patents, literary or artistic property rights.

When applicable, the rate of CIT is aligned with French CIT, ie its nominal rate is 25%.

However, rules governing the computation of the taxable basis are rather flexible, allowing in practice reducing significantly the effective tax rate.

In this regard, the cap mechanism applicable to the tax deduction of qualifying director fees is rather generous compared to that applicable in most EU jurisdictions.

This gives rise to relocation opportunities to Monaco for individual directors – although it is not compulsory for a Monaco joint stock company (‘Société Anonyme Monegasque’) to have Monaco-based directors: director fees are not taxable in the hands of the beneficiary directors in Monaco while allowing reducing the taxable basis of the Monaco paying entity – we also note that director fees do not bear any social charges and the possibility for individual directors of obtaining advantageous Monaco social security insurance under competitive conditions.

A number of corporate tax incentive regimes apply

Qualifying new businesses set up in Monaco can benefit from a progressive five-year tax exemption: a full CIT exemption applies during the first two fiscal years, then CIT is progressively applied, ie CIT is based on 25% of the tax profits of the third fiscal year, increased to 50% the fourth year and 75% the fifth year.

The incentive ‘headquarter’ tax regime makes the Principality of Monaco a preferred jurisdiction to locate foreign companies’ administrative offices. Indeed, qualifying headquarters, which, for the sole benefit of their group, carry out management, coordination or control tasks benefit from a reduced effective CIT rate of circa 2%, calculated on a flat-rate basis of their operating costs.

R&D tax incentives also apply: qualifying R&D businesses based in Monaco are supported through the benefit of R&D tax credits that can net off CIT due by the company, as the case may be.

Absence of ‘exit costs’

There is no ‘tax barrier’ to cross-border financial flows: no withholding tax applies in Monaco to dividend, interest or royalty paid by a Monaco-based entity to non-Monaco beneficiaries.

Besides, shareholders are not taxable on capital gains incurred upon the sale of shares in a Monaco company.

At a glance

- At the level of the Monaco company subject to CIT: CIT tax base may be significantly reduced through the payment of director fees to Monacobased or foreign directors (whether individuals or companies)

- At the level of the UK parent company:

-

- No withholding tax will apply in Monaco on director fees and/or dividends paid by the Monaco company;

- Dividend should be exempt under the parent-subsidiary tax regime;

- Capital gains incurred upon the sale of share in the Monaco company will not be taxable in Monaco and should be exempt in the UK under the substantial shareholding exemption (SSE).

-

VAT – Monaco is part of the European Union VAT systemMonaco forms a customs union with France and is thus part of the European VAT system (Directive 2006/112/CE dated 28 November 2006 on the common system of value added tax ) – the Monaco standard VAT rate is 20%.

As a result of the above, in addition to multinationals expanding in Monaco, we note an increasing number of foreign entrepreneurs relocating to Monaco, thus benefiting from a full income tax exemption, and deploying their business from Monaco, either through consulting services rendered to their foreign-based business – with literally no risk of attracting any tax basis in Monaco based on a deem effective management of the foreign business from Monaco, or through the setting up of a new operating company in Monaco.

/